san francisco sales tax rate 2018

Proposition 172 1993 extended the state sales tax rate of 6 percent. You can print a 9875 sales tax table here.

Sales Tax Collections City Performance Scorecards

San Jacinto CA Sales Tax Rate.

. Three cities follow with combined rates of 10 percent or higher. The California sales tax rate is currently 6. City of South San Francisco Sales Tax Measure W November 2015 San.

The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax. San Gabriel CA Sales Tax Rate. Two of these resulted from recent voter-enacted initiatives notably.

San Jose CA Sales Tax. To avoid late penaltiesfees the Return must be submitted and paid before midnight on. 7750 California City and County Sales and Use Tax Rates Rates Effective 10012017 through 03312018 2 P a g e Note.

Most of these tax changes were approved by. Tacoma 102 percent and Seattle 101 percent Washington and Birmingham Alabama 10 percent. The average sales tax rate in California is 8551.

Next to city indicates incorporated city City Rate County Belden 7250 Plumas Bell Gardens 9500 Los Angeles Bell 9500 Los Angeles Bella Vista 7250 Shasta Bellflower 9500 Los Angeles. This scorecard presents timely information on economy-wide employment indicators real estate and tourism. Has impacted many state nexus laws and sales tax collection requirements.

A county-wide sales tax rate of 025 is. Click here for a larger sales tax map or here for a sales tax table. San Juan Plaza San Juan Capistrano 7750.

San Fernando Sales Tax Renewal. California City and County Sales and Use Tax Rates Rates Effective 04012018 through 06302018. The San Francisco County sales tax rate is 025.

San Joaquin CA Sales Tax Rate. Wayfair Inc affect California. The 9875 sales tax rate in Brisbane consists of 6 California state sales tax 025 San Mateo County sales tax 05 Brisbane tax and 3125 Special tax.

There are a total of 474 local tax jurisdictions across the state collecting an average local tax of 2617. For tax rates in other cities see. The 2018 United States Supreme Court decision in South Dakota v.

California has a sales tax rate of 725. Historical Tax Rates in California Cities Counties. Beginning in tax year 2019 the Return will also include the Early Care and Education Commercial Rents Tax and Homelessness Gross Receipts Tax.

San Geronimo CA Sales Tax Rate. Did South Dakota v. The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable.

The San Francisco Annual Business Tax Return Return includes the Gross Receipts Tax Payroll Expense Tax and Administrative Office Tax. Among major cities Chicago Illinois and Long Beach and Glendale California impose the highest combined state and local sales tax rates at 1025 percent. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025 county sales tax and a 225 special district sales tax used to fund transportation districts local attractions etc.

6 rows The San Francisco County Sales Tax is 025. Had more than 300000 in taxable San Francisco payroll expense. The tax is calculated as a percentage of total payroll expense based on the tax rate for the year.

San Francisco 8625. Next to city indicates incorporated city City Rate County Avalon 10000 Los Angeles Avenal 7250 Kings Avery 7250 Calaveras Avila Beach 7250 San Luis Obispo Azusa 9500 Los Angeles Badger 7750 Tulare. You can print a 9875 sales tax table here.

San Gregorio CA Sales Tax Rate. The sales tax jurisdiction name is South San Francisco which may refer to a local government division. 8617 California has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 35.

There is no applicable city tax. This rate is made up of a base rate of 6 plus a mandatory local rate of 125. San Juan Bautista 9000.

The Homelessness Gross Receipts Tax which was passed on November 6 2018 ballot is imposed on the gross receipts of a business above 50000000. San Fernando CA Sales Tax Rate. Ad Find Out Sales Tax Rates For Free.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last day of February for the prior calendar year Jan. The California sales tax rate is currently 6. To view a history of the statewide sales and use tax rate please go to the History of Statewide Sales Use Tax Rates page.

6 Average Sales Tax With Local. The San Francisco sales tax rate is 0. The purpose of the Economy scorecard is to provide the public elected officials and City staff with a current snapshot of San Franciscos economy.

2 Page Note. Fast Easy Tax Solutions. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax.

Has impacted many state nexus laws and sales tax collection requirements. The sales tax jurisdiction name is San Francisco Tourism Improvement District which may refer to a local government division. San Joaquin Hills CA Sales Tax Rate.

Persons other than lessors of residential real estate ARE REQUIRED to file a Return for tax year 2018 if in 2018 you were engaged in business in San Francisco as defined in Code section 62-12 qualified by Code sections 9523 f and g were not otherwise exempt under Code sections 906 or 954 and you. Our GIS-based sales tax website allows the user to view sales tax receipts from calendar. San Juan Capistrano 7750.

San Francisco CA Sales Tax Rate. The San Francisco sales tax rate is 0. Effective April 1 2018 the following City sales tax rates will.

The County sales tax rate is 025. Beginning January 1 2019 a number of tax law changes will become effective in the City of San Francisco the city. With the addition of locally approved county and municipal taxes the total combined sales tax rate can be as high as 1025 the highest in the United States.

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

San Francisco Prop W Transfer Tax Spur

Understanding Where California S Marijuana Tax Money Goes

At What Income Level Does The Marriage Penalty Tax Kick In

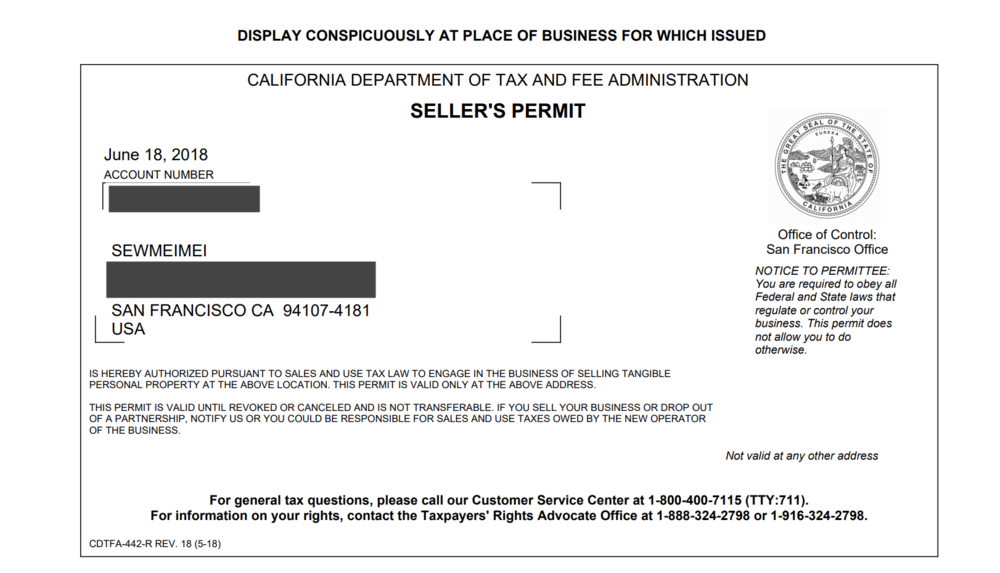

Legal Stuff In San Francisco Sewmeimei

How Congress Can Stop Corporations From Using Stock Options To Dodge Taxes Itep

How Do State And Local Sales Taxes Work Tax Policy Center

Which States Have The Highest Income Tax Rates Fedsmith Com

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Is Tax Higher In New York Than In California Quora

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

California Sales Tax Small Business Guide Truic

Sales Tax On Saas A Checklist State By State Guide For Startups

California State Sales Tax 2018 What You Need To Know Taxjar

Frequently Asked Questions City Of Redwood City

How Do State And Local Sales Taxes Work Tax Policy Center

What Are The State Income Tax Rates For California Quora

Worst In The State S F Sales Tax Data Show Likely Population Decline

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur