tax exempt resale certificate ohio

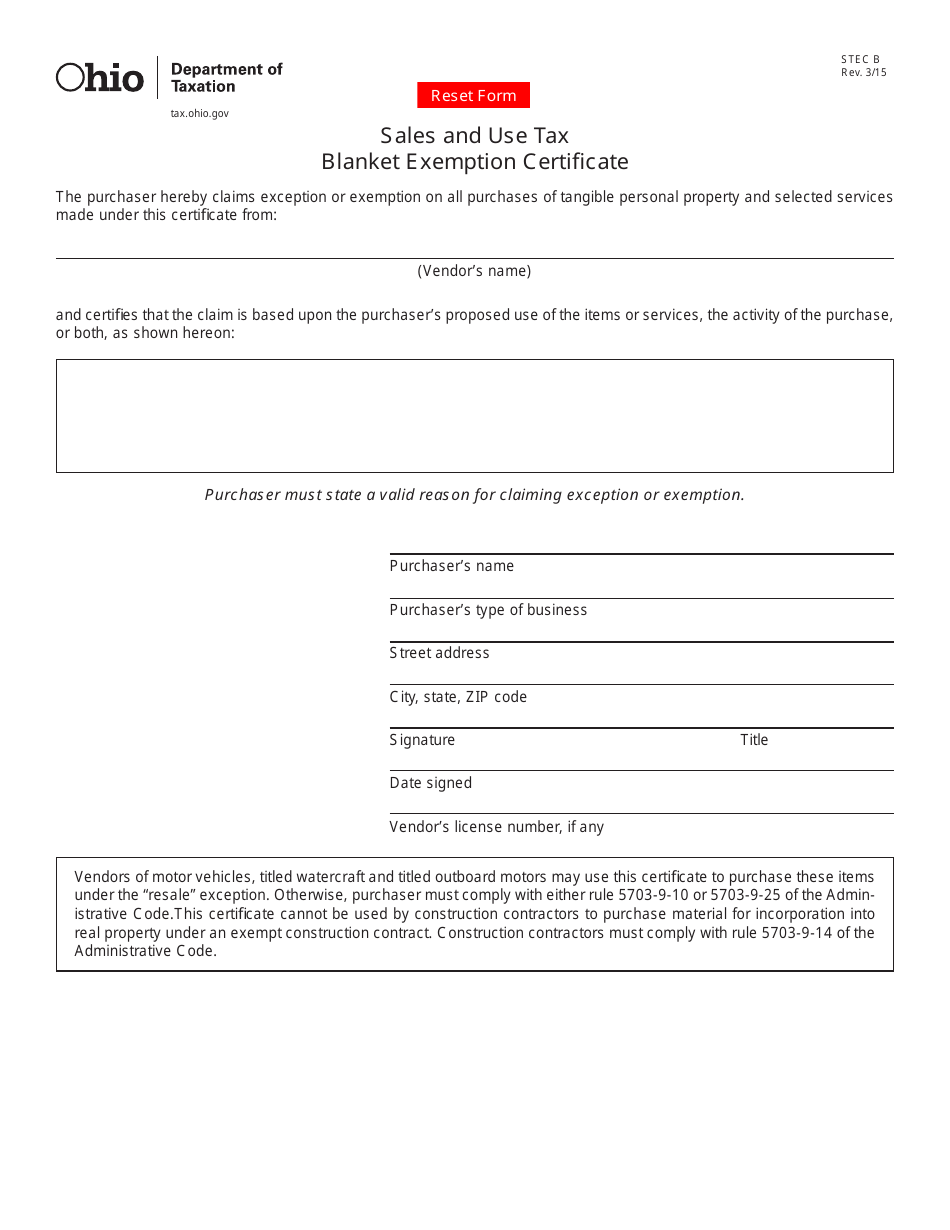

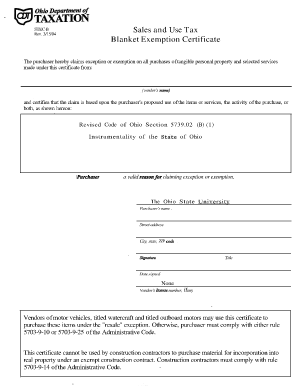

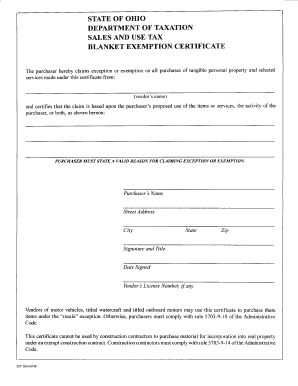

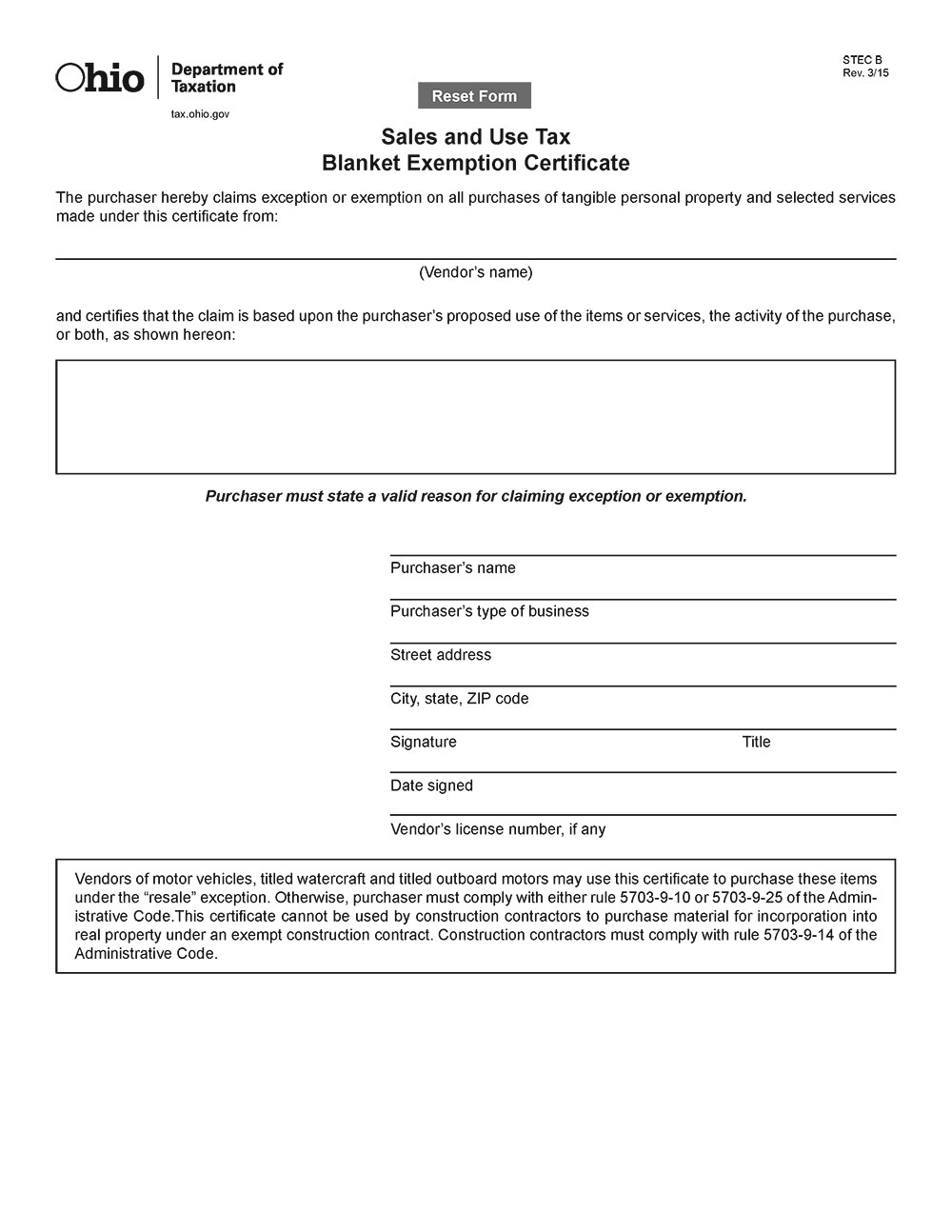

How Do I Obtain A Resale Certificate In Ohio. Sales and Use Tax Blanket Exemption Certificate.

The escrow account should hold a sufficient amount of the purchase price to cover any.

. A As used in this rule exception refers to sales for resale that are excluded from the definition of retail sale by. To get a resale certificate in Arizona you may complete the Arizona Resale Certificate Form 5000A the Multistate Tax Commissions Uniform Sales and Use Tax. This certificate is also known as a tax-exempt certificate and it must be obtained by the business that intends to buy products with an intention to re-sell.

Another closely related permit is an Ohio resale certificate -also known as a sales tax exemption certificate- which grants your business the benefit of being able to buy goods without paying. The seller did not fraudulently fail to collect the tax due. However when such a business with a tax-exempt resale.

An Ohio resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to. If you are a business owner in Ohio you may want to get a Sales Tax Exemption Certificate in order to purchase goods for resale without paying sales tax. A As used in this rule exception refers to sales for resale that are excluded from the definition of retail sale.

This certi fi cate cannot be used by construction contractors to. Ohio Sales Tax Exemption Resale Forms 3 PDFs. Ad signNow allows users to edit sign fill and share all type of documents online.

Sales and use tax. You can do this by. A tax-exempt resale certificate that a business holds only allows it to withhold sales tax on eligible goods and services.

If you are a retailer making purchases for resale or need to make a purchase that is exempt from the Ohio sales tax you need the. A tax resale certificate allows you to not pay sales tax on items that you simply decide to resell. Sales Use Tax Resale Certificate Simple Online Application.

Ohio sales and use tax blanket exemption certificate pdf. Under the resale exception. Ad Download Or Email STEC B More Fillable Forms Register and Subscribe Now.

Name of purchaser firm or agency as shown on permit. Ohio Resale Permit License. Ad Sales Use Tax Resale Certificate Wholesale License Reseller Permit Businesses Registration.

The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services. This will also apply to supplies that are getting to be utilized in products that. It is not uncommon for a resale certificate to be referred to as a resellers permit it can also be referred to or called an exemption certificate.

Resale certificates are usually the same things. If ones certificate does expire the. State of Ohio Taxation The state of Ohio sales tax and use tax rate currently is at 575.

By Jennifer Dunn March 1 2021. Otherwise purchaser must comply with either Administrative Code Rule 5703-9-10 or 5703-9-25. The purpose of the certificate is to document and establish a basis for state and city tax deductions or.

Ohio law requires that during the acquisition process you establish an escrow account. 01-339 Rev9-076 TEXAS SALES AND USE TAX RESALE CERTIFICATE. Expiration of Ohio sales tax exemption certificate In Ohio the Ohio sales tax exemption certificate has no hard or set date of expiration.

Offer helpful instructions and related details about Resale Certificate Ohio - make it easier for users to find business information than ever. Your resale certificate proves that you plan to resell the goods purchased making it unnecessary to collect sales tax at that point. As a retailer you have the chance to buy items that you intend to resell without paying sales tax at the time of purchase.

Create Legally Binding Electronic Signatures on Any Device. Additional sales and use tax can be further levied by the. For other Ohio sales tax exemption certificates go here.

In Ohio you need to complete and present an Ohio Sales and Use Tax Blanket Exemption Certificate to the merchant from which you are buying the products to be resold. The fully completed exemption certificate is provided to the seller at the time of sale or within 90 days subsequent to the date of sale. Example If you are a business called.

Ohio Sales Tax Exemption Form Blanket Iae News Site

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

Form Stec B Download Fillable Pdf Or Fill Online Sales And Use Tax Blanket Exemption Certificate Ohio Templateroller

Filling Out Ohio Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Free Form Sales And Use Tax Blanket Exemption Certificate Free Legal Forms Laws Com

Blanket Certificate Of Exemption Ohio Fill Online Printable Fillable Blank Pdffiller

Ohio Tax Exempt Form Example Fill Online Printable Fillable Blank Pdffiller

Ohio Resale Certificate Trivantage

Ohio Tax Exempt Form For Farmers Fill Online Printable Fillable Blank Pdffiller

Links To All State S Resale Certificates

Form Stec U Fillable Sales And Use Tax Unit Exemption Certificate

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Printable Ohio Sales Tax Exemption Certificates

Ohio Tax Exempt Form Pdf Fill Online Printable Fillable Blank Pdffiller